- Services

-

-

-

Insurance Claim Types

-

-

- Resources & Support

-

-

-

Insurance Claim Support

-

-

- About Us

-

- Contact Us

Our approach to make sure you Settle for better.

Finalize your property damage insurance claim with a team of industry experts.

Why hire a public adjuster?

What is a public adjuster?

Public adjusters get a bad rap. Yes, we said it. And it’s largely because the industry tends to focus on sales over service, put profits before policyholders and inflate claims to make a bigger buck. We started C3 Group to be a public adjuster, without acting like one. We work for you to reach the fair, accurate settlement for your insurance claim. Because that’s what a public adjuster is supposed to do.

-

01

Protecting policyholders

As active leaders in the industry, we work to equip policyholders and make fair, balanced claims the norm.

-

02

Obsessing over details

We use verifiable data, unbiased analysis and forensic investigation techniques to reach the right settlement. And resolve your claim quickly.

-

03

Acting with honesty

We refuse to oversell and underdeliver. We’re committed to full transparency and a smoother process. For every client and every claim.

Our start-to-finish approach to better settlements

Step 1

Inspection

Our highly-trained investigations team visits your site. Using advanced technology, forensic evaluation and independent damage standards, they complete an unbiased evaluation of your property damage and your policy coverage.

Step 2

Estimation

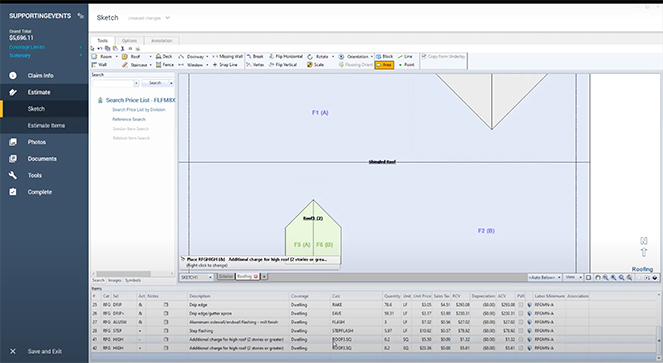

One of our public adjusters and Level 3 Xactimate Certified estimators is assigned to your claim. Our Xactimate estimator compiles a comprehensive and accurate estimate of your loss. The first time.

Step 3

Preparation

With the evidence compiled, your public adjuster finalizes an itemized claim package that includes damage evidence, policy considerations, estimates and reports.

Step 4

Negotiation

Your designated public adjuster handles all back-and-forth with the insurance company, keeping you up to speed and guiding you through the negotiation process.

Step 5

Settlement

Once all stakeholders and contractors are in agreement with the proposed settlement, your public adjuster settles the claim with the insurance carrier – making sure you get the full value you’re entitled to under your policy.

A few of our success stories

Don’t take it from us, let our wins speak for themselves.

Play Video

Hurricane damage – Naples, FL.

A multi-family condo association with 14 total damaged buildings. Prior to C3 Group’s involvement, the COA received an offer that only covered minor repairs months after filing the claim. The board and property manager was referred to C3 Group who was able to properly investigate the claim and negotiate a settlement that was millions of dollars higher than initially offered by the insurer.

Hail damage – Colorado Springs, CO.

Rockrimmon is a strip-style shopping center with five buildings each with varying roof materials that sustained damage in a hailstorm. After the claim was denied by the insurance company, C3 Group was hired to assist in negotiating a proper settlement. Communication was critical due to the many tenants on the property that were affected. C3 group took over the communication and to ensure all parties were up to speed and successfully negotiated a settlement of $1,031,332.75.

Tornado damage – Dallas, TX.

An EF3 tornado impacted 0ver 80,000 SF between two buildings of this private school. A settlement offer of $3M was initially made by the insurance company for the damages. As previous clients of C3 Group, the policyholders engaged them immediately to assist with the claim process. The property’s extensive damage caused a loss to the interior contents and ultimately required temporary structures for the school to remain operational. C3 Group was able to navigate the multifaceted loss and work with the insurance carrier’s experts to negotiate a final settlement of almost $6M.

Newsletter Signup

Sign up and receive updates on storms, industry news, training opportunities, events and more!

Rich data for the right settlement

So you don’t leave money on the table

Insurance is complicated. We bring clarity to the process by

capturing hard data to back up your claim.

capturing hard data to back up your claim.

- Expert investigations

- The right technology

- Xactimate certification

Expert investigations

Our investigations team and trusted partners use detailed analysis, testing and forensic investigations. That means evidence-based conclusions on your property’s material and structural damages.

The right technology

Drones. Matterport 3D imaging. Capacitance meters for moisture detection. We use cutting-edge tech to capture every irrefutable detail.

Xactimate certification

Every member of our investigations team is level 3 certified in Xactimate. This rare level of expertise in the industry helps us produce super-detailed, data-driven estimates to fully substantiate your claim.